Management Practice Insights

DOI: 10.59571/mpi.v2i1.4

Year: 2024, Volume: 2, Issue: 1, Pages: 16-20

Original Article

Sapna Malya 1, Hemant Manuj 2

1 Associate Professor, Finance & Economics at SPJIMR

2 Professor and Executive Dean at Jindal School of Banking & Finance, O.P. Jindal Global (Institution of Eminence Deemed to be University)

Correspondence

Received Date:22 August 2022, Accepted Date:02 January 2024, Published Date:29 March 2024

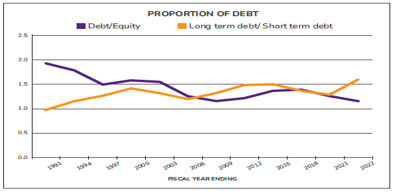

Financing of a business involves several choices and tradeoffs: a key choice that CFOs often make is: “How much debt should we take on to finance our business?” A related question, often neglected is: “What kind of debt?” All forms of lending are not the same and one key dimension of debt is its maturity period. Short-term debt and long-term debt have different impacts on the profitability and valuation of a firm. Do investors demand higher returns on equity if the composition of debt includes more of certain kind of debt? The question has long bothered corporate finance as well as scholars. Recent research by Friewald, Nagler, & Wagner has uncovered an insight that should help CFOs, as it found a clear link between the level of debt, the maturity (ranging from short to long term) of debt and equity returns.1 The essence of their finding is: “… Equity returns increase in short-term leverage but not in long-term leverage”. Meaning that your equity investors expect higher returns on capital, the more your mix of short-term debt increases. In this essay, we explain why this happens, and we outline takeaways for managers of corporate finance. We illustrate how the nature of the industry in which your business operates, impacts your debt financing – both the level, as well as the mix of short- and long-term debt.

Keywords: Finance; Debt financing; Corporate leverage; Equity returns; Capital structure

1 Nils Friewald, Florian Nagler, and Christian Wagner, “Debt Refinancing and Equity Returns,” The Journal of Finance 77, no. 4 (2022): 2287–2329.

2 Franco Modigliani and Merton H Miller, “The Cost of Capital, Corporation Finance and the Theory of Investment,” The American Economic Review 48,no. 3 (1958): 261–97.

3 Zhiguo He and Wei Xiong, “Rollover Risk and Credit Risk,” The Journal of Finance 67, no. 2 (2012): 391–430.

4 Thomas Dangl and Josef Zechner, “Debt Maturity and the Dynamics of Leverage,” The Review of Financial Studies 34, no. 12 (2021): 5796–5840; Peter M DeMarzo and Zhiguo He, “Leverage Dynamics without Commitment,” The Journal of Finance 76, no. 3 (2021): 1195–1250.

5 CMIE, “Corporate India : Financial Performance Summary” (Centre for Monitoring Indian Economy, November 2022), https://prowessdx.cmie.com.

© 2024 Published by SPJIMR. This is an open-access article under the CC BY license (https://creativecommons.org/licenses/by/4.0/)

Subscribe now for latest articles and news.