Management Practice Insights

DOI: 10.59571/mpi.v2i2.6

Year: 2024, Volume: 2, Issue: 2, Pages: 65-68

Original Article

Kunjana Malik 1, Sanjay Motwani 2

1 Assistant Professor with SPJIMR's Finance & Economics department.

2 Student at IIT-Mumbai.

Correspondence

[email protected]

[email protected]

Received Date:08 November 2023, Accepted Date:19 September 2024, Published Date:15 October 2024

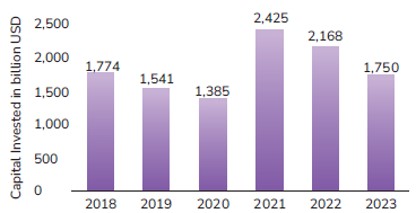

As an institutional investor, or family office manager, you may be familiar with the recent trend of increasing 'dry powder'. In private equity speak, dry powder refers to “the amount of committed, but unallocated capital a firm has on 1 hand”. In other words, it's an unspent cash reserve that's waiting to be invested. To put dry powder to use, investors may wish to navigate the private equity (PE) landscape, encompassing both venture capital (VC) and buyout strategies. While all investors focus on top-performing funds, consistent performers are sometimes overlooked due to recency bias. Hence, a key question arises: How can investors recognize skillful PE managers with a proven track record? Is there an easily discernible pattern that investors should look for? Recent research by Robert S Harris, Tim Jenkinson, Steven N. Kaplan, and Ruediger Stucke provides a much-needed answer 2

Keywords: Operations; Private equity; Buyout; Venture capital; Persistence of funds

1“What Is Dry Powder in Private Equity (PE) and Venture Capital (VC)?” PitchBook (blog), March 25, 2024, https://pitchbook.com/blog/what-is-drypowder.

2 Robert S. Harris et al., “Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds,” Private Equity 81 (August 1, 2023):102361, https://doi.org/10.1016/j.jcorpfin.2023.102361

3 Fredrik Dahlqvist et al., “Private Markets: A Slower Era,” McKinsey Global Private Markets Review 2024 (New York, USA: McKinsey& Co., Inc., March 2024).

4 “What Is Dry Powder in Private Equity (PE) and Venture Capital (VC)?”

5 Hugh MacArthur, “Global Private Equity Report 2024” (Bain & Company, 2024), https://www.bain.com/insights/topics/global-private-equity-report/

6 Bain & Company, “Dry Powder: Global Growth by Fund Type 2023” (Statista: Bain & Company, March 2024), https://www.statista.com/statistics/1246617/growth-in-dry-powder-globalby-type/

7 Harris et al., “Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds.”

8 StartupLanes, “The Success Story of Sequoia Capital: Landmark Investments and Astonishing Returns,” August 25, 2024, https://www.linkedin.com/pulse/success-story-sequoia-capital-landmarkinvestments-astonishing-mf3uf

9 Ajay Sharma, “Sequoia Capital: The VC Firm Behind the World's Most Successful Startups,” July 9, 2023, https://www.linkedin.com/pulse/sequoiacapital-vc-firm-behind-worlds-most-successful-ajay-sharma

10“Company – Kalaari Capital,” 2023, https://kalaari.com/company/

11“Kalaari Capital,” n.d., https://kalaari.com/portfolio/

12 James Thorne, “SoftBank Vision Fund: Returns, Investments and Strategy,” May 14, 2024, https://pitchbook.com/news/articles/softbankvision-fund-performance

13 David Friedlander, “Why WeWork Failed,” Medium (blog), August 16, 2023, https://davidfriedlander.medium.com/why-wework-failed-d1bdee471f5d

© 2024 Published by SPJIMR. This is an open-access article under the CC BY license (https://creativecommons.org/licenses/by/4.0/)

Subscribe now for latest articles and news.